The Health Insurance Trust strives to offer participating districts and their members a broad range of benefit choices to fit your needs. The Trust provides alternate benefit options because the Board of Trustees understands that different members have different circumstances and different coverage needs.

When we launched the preferred plan idea, our objective was to take advantage of the economy of scale to help districts and their members gain access to comprehensive and affordable plans by using our group purchasing power. At the same time, the districts have the autonomy to negotiate independently with their unions, within certain parameters.

The Board developed the preferred plans with three principles in mind:

- The preferred plans represent the best plan design practices being used by School Districts for their health benefits plans.

- The benefit levels represent a reasonable set of options based on School Districts’ budgetary and collective bargaining needs.

- The benefit levels allow the Trustees to continue to improve the Trust’s relationships with our carriers and pharmacy benefits manager through additional reductions in administrative fees and risk charges.

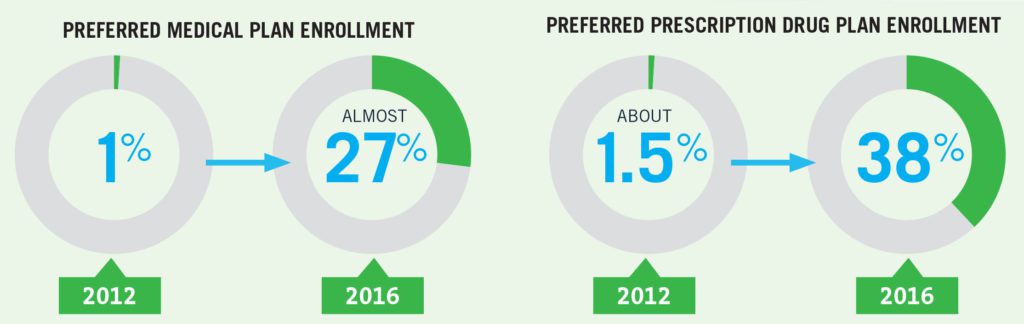

Over the years, enrollment in the preferred plans has continued to grow, demonstrating that the plans are meeting your needs and those of the districts.

For example in 2012, just over 1% of our members who were in enrolled in a Blue Shield of Northeastern New York plan were enrolled in one of the preferred PPOs (Preferred Provider Organizations). At the end of 2016, that number had jumped to almost one-third of our members.

We have seen the same kind of rise in our preferred prescription drug plan enrollment. In 2012, about 1.5% of members were enrolled in a preferred prescription drug plan. In 2016, enrollment had risen to more than one-third.

Enrollment in the CDPHP and MVP plans has stayed fairly even over time.

While we are happy that the preferred plans are a success, we are not satisfied. We will continue to work with our advisors and insurance partners to design plans that are comprehensive, cost-effective and high quality. We also want to hear from you to make sure the plans are meeting your needs.